Electric Vehicle Market Size to Reach USD 2,131.89 Billion by 2032 | CAGR 13.2% (2026–2032)

Electric Vehicle Market Size is projected to reach USD 2,131.89 billion by 2032

Asia Pacific dominated the electric vehicle market, accounting for 51.51% of the market share in 2024.”

PUNE, MAHARASHTRA, INDIA, February 7, 2026 /EINPresswire.com/ -- The global electric vehicle (EV) market was valued at USD 713.93 billion in 2024 and is projected to grow from USD 892.63 billion in 2025 to USD 2,131.89 billion by 2032, registering a CAGR of 13.2% during the forecast period. Asia Pacific dominated the global market with a 51.51% share in 2024, supported by large-scale manufacturing, battery integration, and strong domestic demand.— Fortune Business Insights

The electric vehicle market is transitioning from early-stage adoption to a structurally resilient pillar of the global automotive industry. Growth is driven by declining battery costs, expanding charging infrastructure, and increasing regulatory pressure to decarbonize transport systems. Automakers are rapidly reallocating capital toward dedicated EV platforms, vertically integrated battery supply chains, and software-defined vehicle architectures, reducing reliance on internal combustion engine optimization.

Get a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/electric-vehicle-market-101678

Electric Vehicle Market Overview

Electric vehicles are gaining widespread acceptance due to their lower emissions, reduced operating costs, and improving real-world performance. Battery electric vehicles (BEVs) continue to lead adoption as governments tighten emissions standards and incentivize zero-emission mobility. Fleet operators and urban mobility providers increasingly view electrification as an economically rational choice rather than a regulatory obligation.

Asia Pacific leads global EV production and consumption, while Europe remains a regulation-driven market emphasizing emissions compliance. North America is witnessing accelerated adoption backed by domestic manufacturing incentives, charging infrastructure investments, and consumer tax credits. Emerging economies show slower near-term uptake but present long-term growth potential as infrastructure deployment expands.

Electric Vehicle Market Trends

Rising Investment in Electric Mobility: OEMs are significantly expanding EV portfolios and manufacturing capacity. For example, BYD announced plans in March 2025 to establish its first EV manufacturing facility in India, alongside a proposed 20-GW battery plant, targeting production of 600,000 EVs annually within five to seven years.

Shift Toward Mass-Market EVs: Demand is increasingly concentrated in mid-priced passenger vehicles and light commercial EVs, where total cost of ownership advantages are most visible.

Technology and Platform Evolution: Purpose-built EV architectures, battery chemistry diversification, and centralized vehicle computing systems are reshaping product strategies.

Price Competition and Faster Refresh Cycles: Intensifying competition is driving affordability while compressing margins, particularly in high-volume segments.

Market Drivers

Favorable Government Policies and Subsidies: Incentives such as tax exemptions, reduced registration fees, and public charging access continue to stimulate demand globally.

Strict Emissions Regulations: Governments across Europe, Asia Pacific, and North America enforce fleet-average CO₂ targets and zero-emission mandates, structurally favoring EV adoption.

Lower Total Cost of Ownership: Reduced fuel, maintenance, and operating costs strengthen the economic case for electric vehicles, especially for commercial fleets.

Energy Security and Sustainability Goals: Electrification reduces dependence on imported fossil fuels and aligns transportation with renewable energy strategies.

Market Restraints

High Upfront Vehicle Costs: Battery systems remain a major cost component, limiting affordability in entry-level segments.

Charging Infrastructure Gaps: Uneven availability of fast-charging networks continues to affect consumer confidence, particularly outside urban areas.

Supply Chain Volatility: Concentration of critical minerals such as lithium and nickel introduces cost and sourcing risks.

Market Opportunities

Expansion of public and private charging infrastructure represents the most critical growth opportunity. Governments are making large-scale investments to reduce range anxiety and support mass adoption. Commercial vehicle electrification—particularly in last-mile delivery, urban logistics, and municipal fleets—offers strong long-term upside due to predictable usage patterns and faster return on investment.

Market Segmentation Highlights

By Vehicle Type: Passenger vehicles dominate market share, while commercial vehicles are expected to register the fastest growth.

By Propulsion: Battery Electric Vehicles (BEVs) hold the leading position due to zero-emission compliance and superior operating economics.

By Drive Type: Front-wheel drive EVs lead volume adoption due to affordability and efficiency.

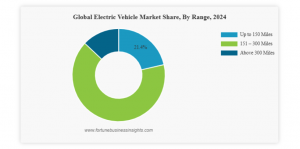

By Range: The 151–300 mile segment dominates global demand, balancing cost, performance, and daily usability.

By Component: Battery pack and high-voltage components account for the largest value share, reflecting their central role in cost and performance.

Regional Insights

Asia Pacific: Largest market globally, led by China, Japan, and India, supported by manufacturing scale and policy alignment.

North America: Fastest-growing region, driven by federal incentives, domestic EV production, and expanding charging infrastructure.

Europe: Regulation-driven market with strong adoption in Germany, the U.K., and France.

Rest of the World: Gradual growth supported by pilot programs, urban air-quality initiatives, and fleet electrification.

Have Any query? Ask Our Experts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/electric-vehicle-market-101678

Competitive Landscape

The global electric vehicle market is highly competitive, with leading players such as BYD Company Ltd., Tesla, Volkswagen AG, Toyota Motor Corporation, and Ford Motor Company focusing on battery innovation, platform scalability, and localized production. Chinese manufacturers continue to exert pricing pressure globally through integrated supply chains and manufacturing scale.

Industry Developments

March 2025: Toyota partnered with Idemitsu Kosan to establish a lithium sulfide facility supporting solid-state battery production.

April 2024: BYD expanded deployment of blade battery technology to enhance thermal safety and range.

January 2024: Tesla upgraded battery production capabilities to support next-generation lithium-ion cells.

Report Coverage

The report provides comprehensive analysis across vehicle type, propulsion, drive type, range, components, and regions, along with insights into market trends, growth drivers, restraints, opportunities, and competitive dynamics shaping the global electric vehicle industry.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.